The Ultimate Guide To Mileage Tracker

Table of ContentsNot known Facts About Mileage TrackerThe Ultimate Guide To Mileage TrackerMileage Tracker for BeginnersMileage Tracker Things To Know Before You Get ThisThe Best Guide To Mileage TrackerGetting The Mileage Tracker To Work

A web-based coordinator ought to be able to give you a rather accurate price quote of gas mileage for the journey concerned. While it may appear like a strenuous task, the benefits of maintaining an auto mileage log are remarkable. Once you get involved in the habit of tracking your gas mileage, it will certainly end up being acquired behavior to you.

All set to begin your productivity trip? Inspect out our collection of notebooks!.?. !! Portage Notebooks is located in Northeast Ohio and has actually been creating specialist notebooks for media, police, and businesses for over fifty years. Our notebooks are used the finest materials. If you have an interest in finding out more about performance, time administration, or notebook organization ideas, see our blog site. If you have any questions, do not be reluctant to reach out - email us at!.

For small company owners, tracking gas mileage can be a tiresome but essential job, especially when it pertains to optimizing tax reductions and managing overhead. The days of manually recording mileage in a paper log are fading, as electronic gas mileage logs have made the procedure a lot extra effective, exact, and practical.

Our Mileage Tracker Ideas

Among one of the most substantial advantages of making use of an electronic gas mileage log is the moment it saves. With automation at its core, digital devices can track your trips without requiring manual input for each journey you take. Digital gas mileage logs take advantage of GPS modern technology to immediately track the range took a trip, classify the trip (e.g., business or personal), and generate detailed reports.

The app does all the job for you. Time-saving: Save hours of hand-operated data entry and avoid human mistakes by automating your gas mileage logging procedure. Real-time monitoring: Instantly track your miles and create reports without waiting till the end of the week or month to log journeys. For local business owners, where time is cash, using an electronic gas mileage log can considerably simplify daily operations and totally free up even more time to concentrate on growing business.

Some business proprietors are vague concerning the benefits of tracking their driving with a gas mileage application. In a nutshell, tracking mileage throughout company travel will help to enhance your fuel efficiency. It can also aid decrease automobile wear and tear.

Mileage Tracker Things To Know Before You Get This

This article will reveal the benefits connected with leveraging a mileage tracker. If you run Bonuses a distribution company, there is a high opportunity of spending long hours when traveling daily. Local business owner generally locate it hard to track the distances they cover with their lorries considering that they have a lot to think around.

In that instance, it implies you have all the chance to improve that element of your organization. When you utilize a gas mileage tracker, you'll be able to tape-record your costs much better. This helps your overall monetary documents. You 'd be able to minimize your costs in certain areas like taxes, insurance policy, and vehicle wear and tear.

Gas mileage tracking plays a big duty in the lives of lots of drivers, workers and firm choice makers. It's a small, daily point that can have a large effect on personal lives and profits. So exactly what is gas mileage monitoring? What does gas mileage monitoring suggest? And what makes a mileage tracker app the very best mileage tracker application? We'll damage down every one of that and extra in this post.

A Biased View of Mileage Tracker

Gas mileage tracking, or mileage capture, is the recording of the miles your drive for business. There are a couple of factors to do so. Before the TCJA, W-2 staff members would track miles for tax deduction. Nevertheless, this is no more an option. Most permanent workers or contract workers tape-record their mileage for repayment purposes.

It is necessary to keep in mind that, while the tool utilizes GPS and activity sensor abilities of the phone, they aren't sharing locations with employers in real time - mileage tracker. This isn't a security effort, but an extra practical method to capture the organization journeys traveled properly. A totally free mileage capture app will certainly be hard to come by

9 Simple Techniques For Mileage Tracker

Mileage applications for specific vehicle drivers can cost anywhere from $3 to $30 a month. Our group has decades of experience with gas mileage capture. One thing we do not offer is a single-user gas mileage app. We understand there are a great deal of workers around that need an app to track their mileage for tax and compensation purposes.

There are a substantial number of advantages to utilizing a gas mileage tracker. Allow's discover these advantages even more, beginning with one of the most important reasons to apply a gas mileage tracking app: IRS compliance.

Expense repayment fraud accounts for 17% of business cost fraudulence. With an automatic mileage monitoring application, business obtain GPS-verified gas mileage logs from their staff members.

The Best Strategy To Use For Mileage Tracker

Automating gas mileage monitoring enhances efficiency for those in webpage the field and those busy filling up out the logs. With a gas mileage application, logs can easily be sent for compensation and cost-free up the administrative job of validating all staff member mileage logs.

Again, professionals primarily utilize organization mileage trackers to maintain track of their gas mileage for tax obligation reductions. What makes the ideal gas mileage tracker app?

Ariana Richards Then & Now!

Ariana Richards Then & Now! Michael Jordan Then & Now!

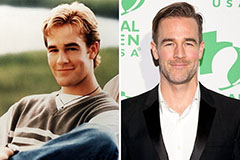

Michael Jordan Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!